Microsoft Azure for Financial Services

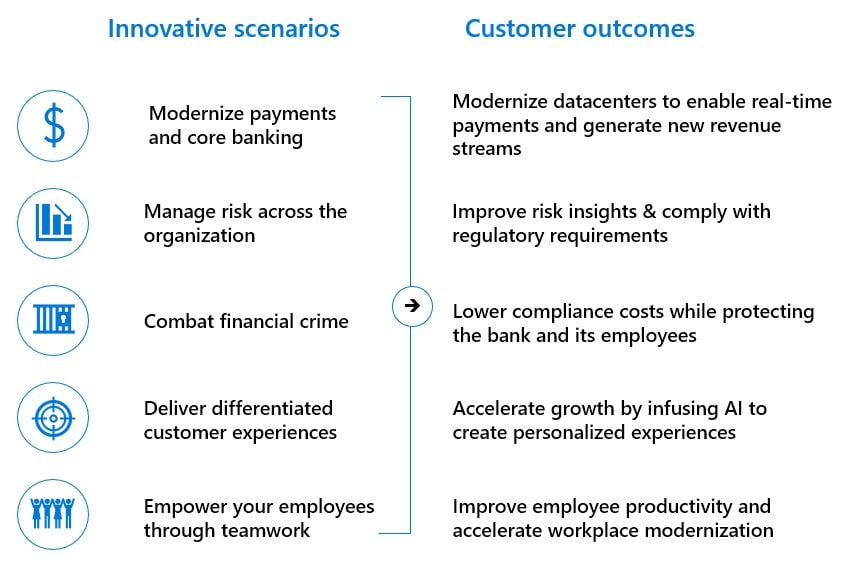

Financial services companies benefit from the Microsoft Cloud’s world-class reliability and performance combined with security, storage, privacy, compliance, transparency and availability. InCycle is skilled at helping customers meet the needs of the banking market now and in the future.